First Swing Trade of 2026

Volatus Aerospace Inc. (FLT.VN / TAKOF)

Kicking off 2026 with a swing trade I took recently. This is simply a record of what I did and why. This is NOT a recommendation.

The Trade

Position: Long

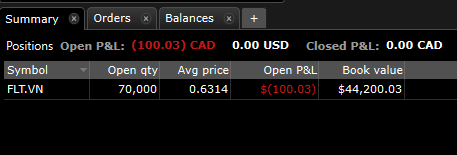

Shares: 70,000

Average Price: 0.6314

I bought FLT.VN after it spent the better part of six months going nowhere and then started to show signs of life above the 0.60 area.

Why I Took It

1. Sector momentum

There’s been money rotating into drone-related names lately. A few of them have already made strong moves, and this one looked like it was lagging while building a base.

2. News sensitivity

With geopolitical uncertainty back in focus and NATO being a constant headline, I’m paying attention to companies that could react to defense-related news. Volatus has exposure here, which made it more interesting to me.

3. Structure

Price had been consolidating for months and recently held above 0.60. That gave me a clear area to define risk without needing a wide stop.

Risk

My risk on the trade is roughly 0.56, which works out to about $5k CAD if I’m wrong. Position size was set with that in mind. If it loses that level, I’m out — no story, no hope.

How I’m Thinking About It

If the stock continues to hold and push higher, I’ll look to scale out into strength rather than trying to predict a top. If it rolls over, I’ll respect the risk and move on.

Some trades work. Some don’t. The goal is staying consistent and protecting capital.

This is a personal trade journal entry shared for educational purposes only. Not investment advice.